ABOUT USSustainability

Sustainability Approach

Board Statement

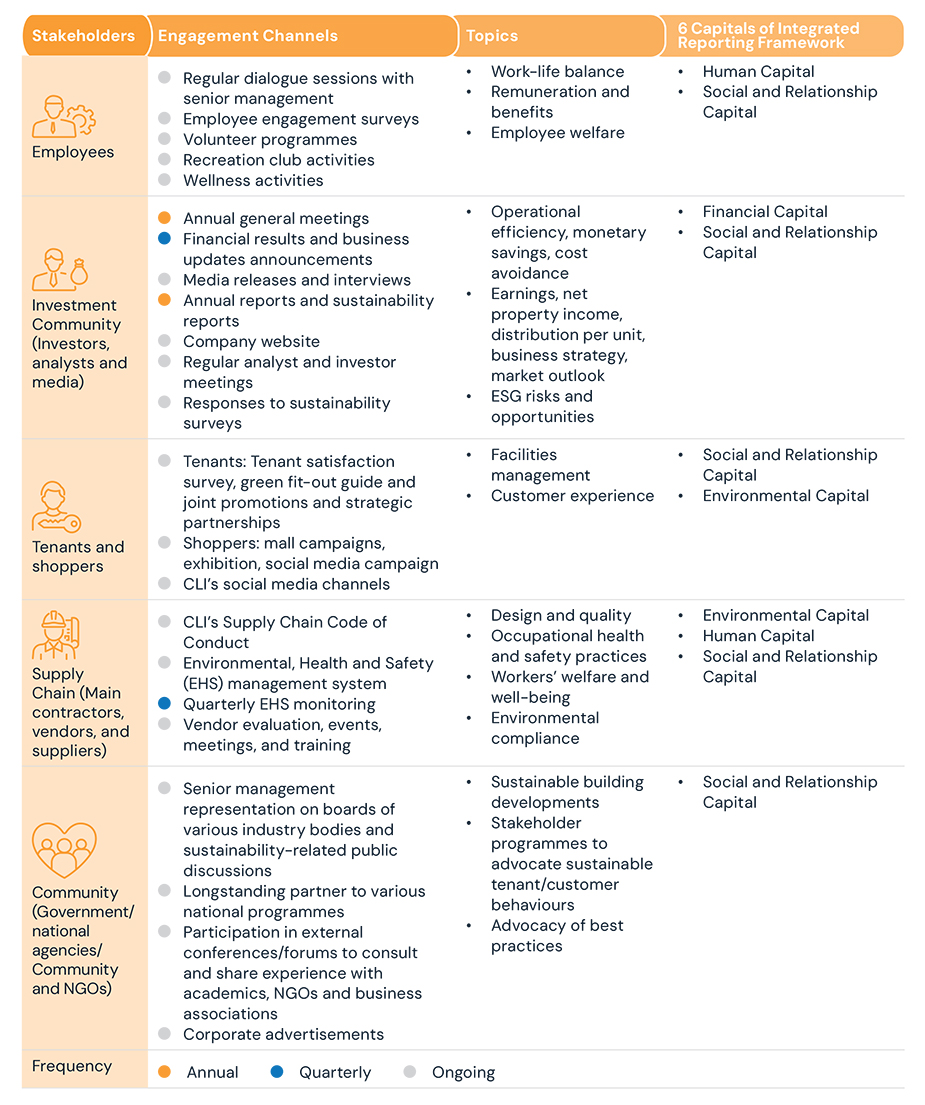

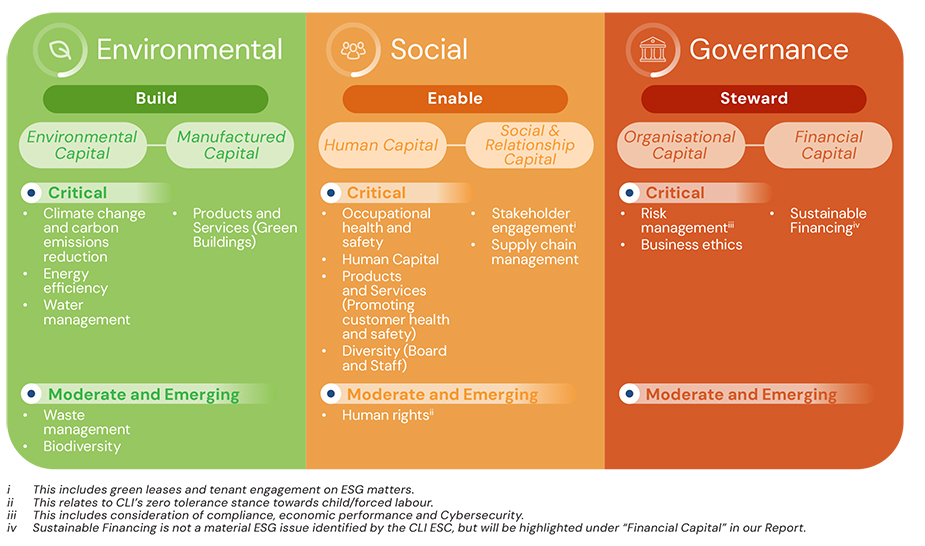

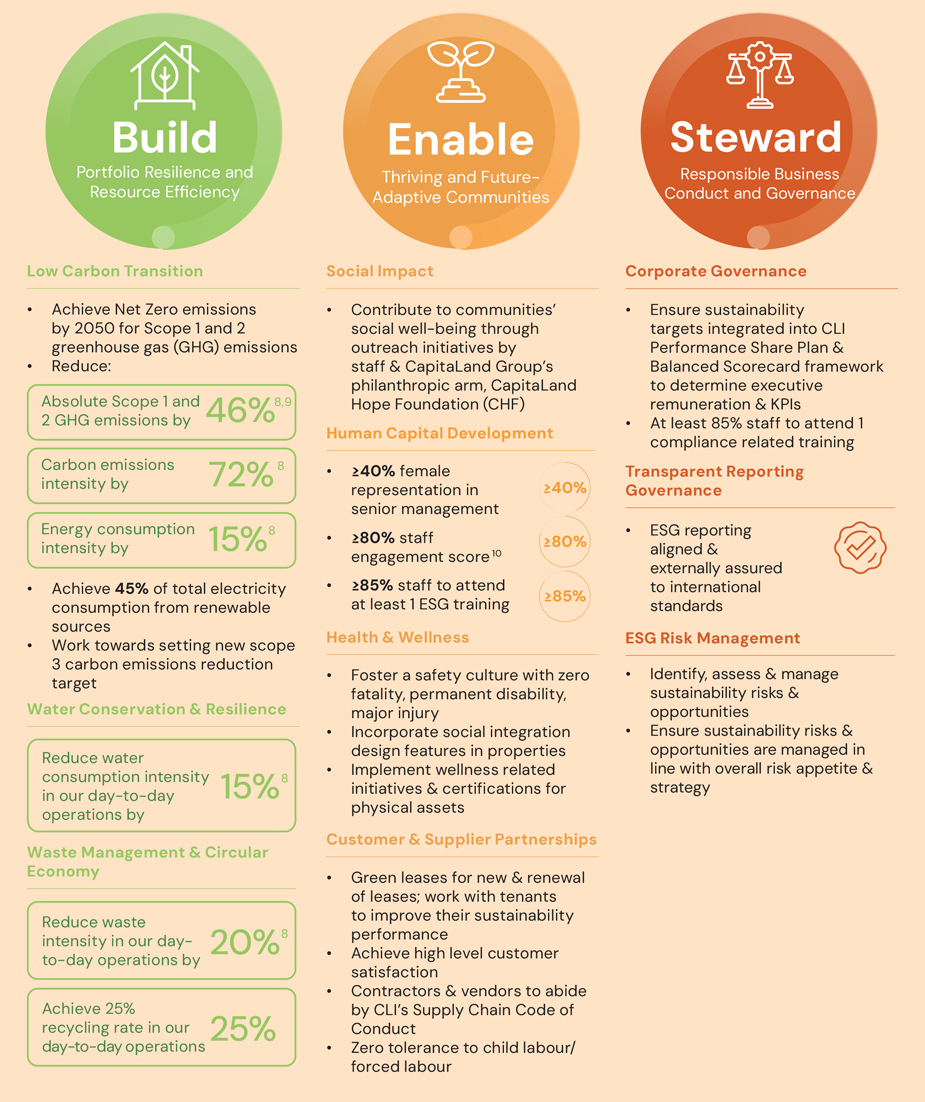

At CLCT, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. The material Environmental, Social and Governance (ESG) factors have been identified and encapsulated in the CapitaLand Investment 2030 Sustainability Master Plan (SMP), which was refreshed in 2023 as part of the review by the CapitaLand Investment Board of Directors together with Management.

The CapitaLand Investment 2030 Sustainability Master Plan steers our efforts on a common course to maximise impact through building portfolio resilience and resource efficiency, enabling thriving and future-adaptive communities, and stewarding responsible business conduct and governance. Ambitious ESG targets have been set which include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi). CapitaLand Investment revised its SMP targets to elevate its SBTi-approved targets in line with a 1.5°C scenario, incorporate its Net Zero commitment, and enhance its focus on social indicators.

The CLCT Board is responsible for overseeing the REIT’s sustainability efforts, and takes ESG factors into consideration in determining its strategic direction and priorities. The CLCT Board also approves the executive compensation framework based on the principle of linking pay to performance. CLCT’s business plans are translated into both quantitative and qualitative performance targets, including sustainable corporate practices, and are cascaded throughout the REIT.

Sustainability Commitment

CapitaLand China Trust commits to CLI 2030 SMP goals and targets.

Note: Enable & Steward targets are intended to reflect the organisation-wide goals

set by CLI on a group basis, and are intended to be implemented subject

to and taking into account (i) fair & equitable employment practices and principles under applicable

laws and market practice and (ii) the business and

operational needs of the company and the organisation, as applicable.

8 Using 2019 as the base year

9 This refers to gross greenhouse gas emissions. For more information on greenhouse gases

covered by this target, please refer to the GHG Emissions Data

Methodology.

10 Employee engagement score of at least 80% (with at least 85% participation).

Sustainability Governance

Responsible Business Conduct

CLCT is committed to promoting respect for human rights and proactively addressing human rights issues that may affect the REIT’s activities, in accordance with CLI’s policies and commitments. These policy commitments are endorsed by the boards and management of both CLI and CLCTML, and are integrated into CLCT’s operations and business relationships.

CLCT adopts CLI’s Social Charter to uphold human dignity and self-respect. This charter applies to our workforce and supply chain, covering human rights, child labour, forced labour, human trafficking, code of conduct, diversity and inclusion, and promoting a healthy work-life balance.

Additional human rights commitments, such as grievance procedures, anti-harassment policies, and remedial measures, are implemented across various levels of the organisation.

-

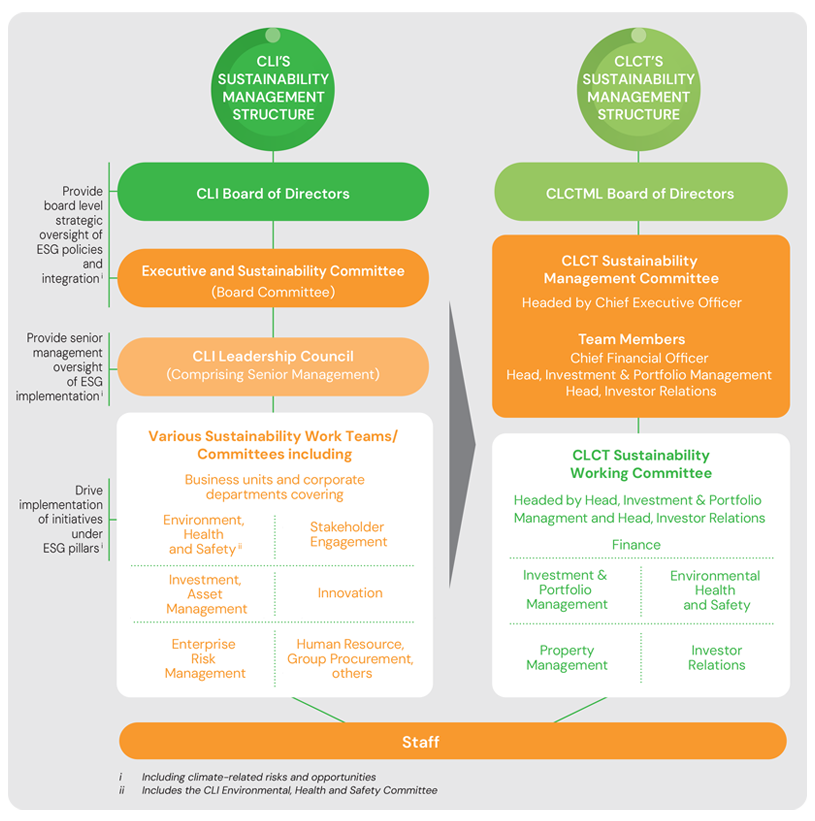

Strategic Sustainability Management Structure

-

Board, Top Management and Employee Commitment

Strategic Sustainability Management Structure

Board, Top Management and Staff Commitment and Involvement

Role of Sponsor’s Board, Management and Employees

The Sponsor’s (CLI) Board recognises the importance of sustainability as a business imperative and ensures that sustainability considerations are factored into CLI’s strategy development. This enables CLI to remain competitive and resilient in an increasingly challenging business environment.

The CLI Board is kept informed on a regular basis through its Executive and Sustainability Committee (ESC)11 on CLI Group’s sustainability management performance, key material issues12 identified by stakeholders, and the planned follow-up measures. The CLI Board is updated by the Risk Committee and Audit Committee at least once a year.

The CLI Board discusses matters relating to sustainability risks and relevant performance metrics, which include CLI Group’s progress on achieving the carbon emissions reduction targets, green building certification, human capital development, stakeholders’ expectations on climate change, social impact and/or other matters. The CLI Board is also informed of any incidents relating to workplace safety, business malpractice, and environmental impact, which may include climate-related damage or disruptions.

CLI Group’s Chairman also chairs the ESC which is a Board Committee. This committee is responsible for overseeing CLI Group’s sustainability strategies, including providing guidance to management and monitoring progress against achieving the goals of CLI Group’s sustainability initiatives.

The CLI Group’s sustainability targets12 are reviewed and approved by the ESC and Board. The ESC is scheduled to meet on a quarterly basis. The ESC’s responsibilities12 are set out in the Board committees’ role descriptions in CLI’s Corporate Governance Report. For more information, please refer to the CLI’s AR 2024 on Board Committees.

The CLI Leadership Council makes strategic resource allocation decisions and meets on a regular basis. The CLI Leadership Council comprises the CLI Group Chief Executive Officer (CEO), the CEOs of the various business units, and key management executives of the corporate office.

The sustainability work teams comprise representatives from CLI’s business units and corporate functions. Each business unit has its own Environmental, Health, and Safety (EHS) Committee to drive initiatives in the countries where it operates, with support from various departments.

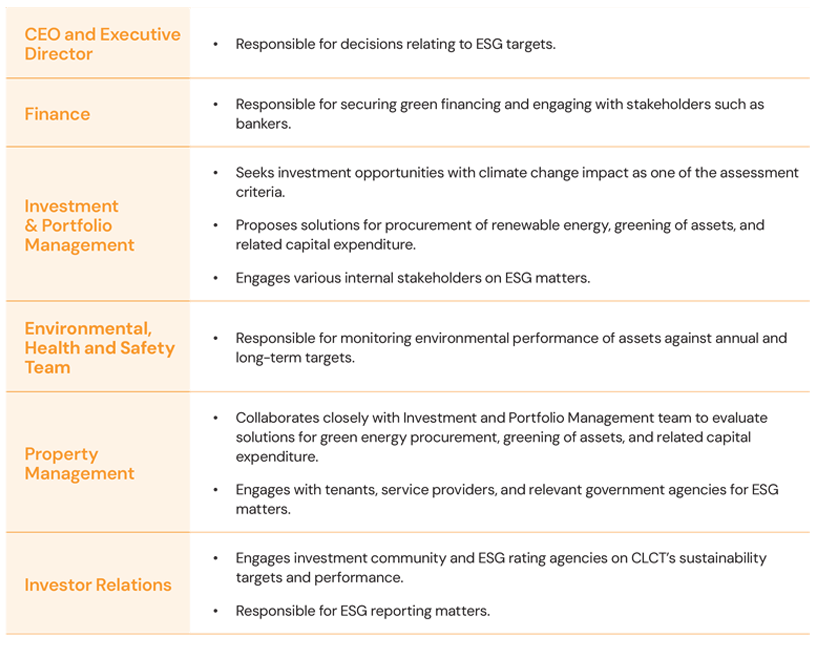

Role of CLCTML Board, Management and Employees

CLCT has established a Sustainability Management Committee (SMC), chaired by the CEO of the REIT Manager, to focus on sustainability and climate-related matters. The SMC, comprising senior management, oversees sustainability objectives and strategies and provides regular updates to the Board of Directors on the value and mission statements, goals, strategies overviews, policies and progress related to sustainable development.

The SMC is supported by CLCT’s Sustainability Working Committee (SWC), which comprises key members from various business functions, to implement sustainability-related initiatives across CLCT’s operations in line with CLI’s sustainability framework and policies. CLCT’s sustainability governance aligns with the Sponsor’s sustainability management. CLCT is represented at the CLI Senior Leadership Council by the CEO of the REIT Manager of CLCT who provides guidance on sustainability strategies and goals for CLCT.

The content of this report, including material ESG topics, is reviewed and approved by the CLCTML Board of Directors, which also discusses and reviews sustainability policies and strategies during its meetings.

CLCT’s SWC collaborates closely with CLI’s EHS Committee to implement sustainability-related initiatives across its operations. In addition to environmental initiatives, CLI also champions Occupational Health and Safety (OHS) with commitment from the top management and employee participation through an integrated EHS Management System as well as stakeholder engagement activities. CLCTML’s CEO is accountable for the EHS performance of CLCT. Employees are encouraged to be forthcoming in reporting both environmental-related issues and OHS-related incidents, including non-compliances and non-conformities.

Key Performance Indicators (KPIs) Tied to Remuneration

The remuneration for all employees in the REIT Manager, including top management, is linked to CLCT’s environmental targets through KPIs. CLCT aims to minimise environmental impacts by setting targets for green building ratings, carbon emissions, energy, water, and waste reduction.

Beyond environmental KPIs, CLCT also integrates OHS KPIs with the remuneration of all CLCT employees, including its top management. These targets are tied to the remuneration of top management and employees.

Further information on this can be accessed in the Environmental and Social chapter of this Report.

11 The Executive Committee and the Strategy and Sustainability

Committee merged with effect from 1 January 2025, to form the Executive and Sustainability

Committee.

12 This includes those related to climate-related risks and opportunities.